TUE JUN 7, 2022 BY OPPENHEIM LAW ON REAL ESTATE

By Roy Oppenheim

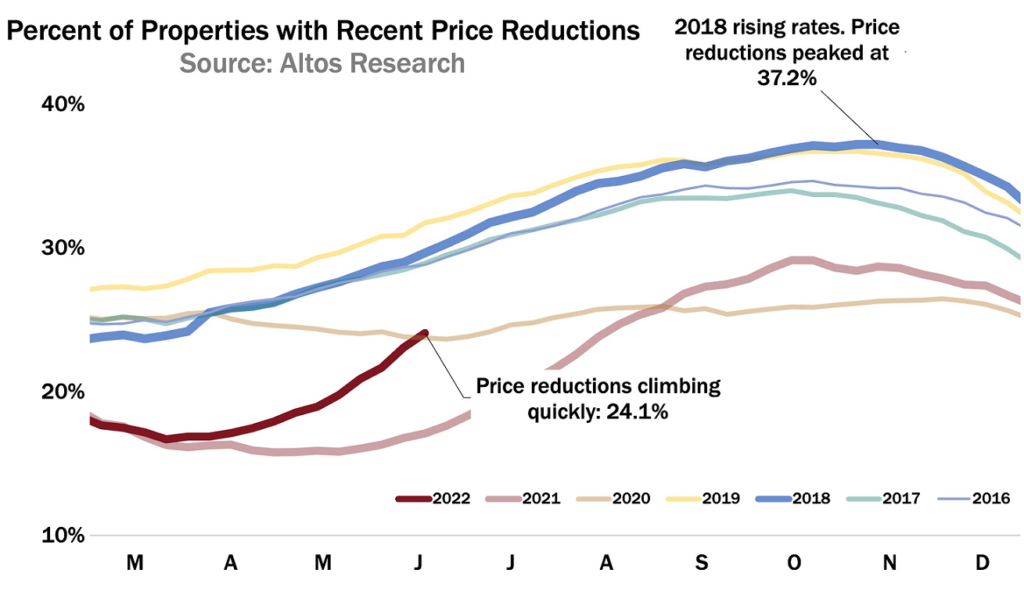

There is new market research that indicates that home price listings throughout the United States have been reduced 24.1% over the past few weeks. Why? With increased demand and short supply of homes, many sellers have been able to place their homes on the market for much higher prices with buyers willing to pay over their asking price. However, with increased inflation, mortgage rates rising, and workplace layoffs there may be, overall, a shift in the housing market. Add to those conditions that most people according to the latest public opinion polls are pessimistic about the economy and stock and crypto markets that have fallen dramatically this year.

What about South Florida Home Prices?

Picture courtesy Altos Research

Yet, the question remains as to whether home prices in South Florida will begin to slow down. Home sales and prices are still high here, and housing inventory remains tight. Why? Our climate is one factor. Another is that favorable tax laws draw people and businesses from higher-tax states such as New York and California. However, with rising inflation, higher mortgage rates may prevent purchasers from buying. Further, with inflation, building supplies for new construction has led to higher home prices. Other factors that impact the South Florida housing market include global markets and the decrease of investment in South Florida due to the Ukraine/Russia conflict. Additionally, a strong dollar prevents foreigners that want to purchase real estate in the United States, making such purchases even more expensive for them.

Zillow predicts that annual home sales will gradually slow through January 2023 due mostly to increased inflation. As we indicated in an earlier blog, increasing mortgage rates is a reason for the slowdown. The forecast is that 30-year fixed mortgages will average 4.5%— up from 3.1% in 2021. Such higher interest rates place pressure downward on the housing market as some potential purchasers will now be ineligible for the loan amounts they want, while others will simply price out some home purchasers.

Picture courtesy Luixlifemiamiblog

What does this all mean?

Change is in the air as a reduction in home prices will perhaps open the market to more people who are currently unable to purchase homes, assuming that inflation is kept in check. In South Florida, the need, however, for affordable housing still remains, and the overall demand for housing outweighs the supply. As we have stated previously, the result is an inevitable disruption the current housing market.