By Kerry Smith

More buyers want to relocate – but fewer do thanks to a tight inventory of available homes. Phoenix is No. 1 but Florida cities hold all spots from No. 3 to No. 7.

SEATTLE – One in four U.S. homebuyers (25.4%) want to move to a different metro area, largely to escape high home prices where they live now. A year ago it was 23%; before the pandemic it was less than 20%. And, overall, five Florida metro areas rank in the top 10 go-to cities in the U.S.

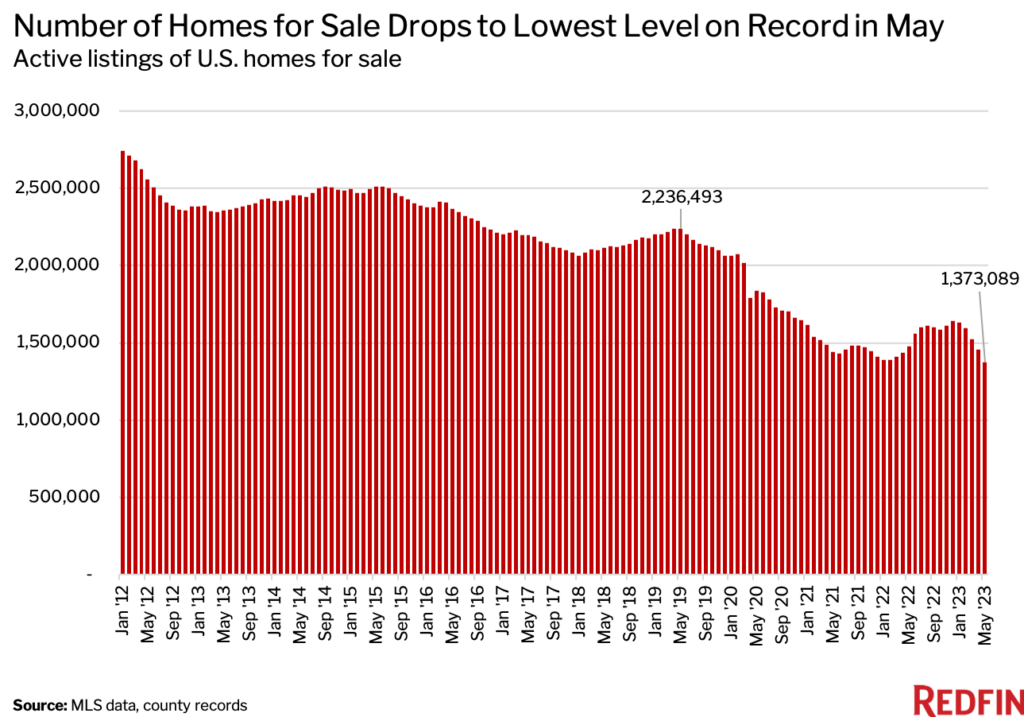

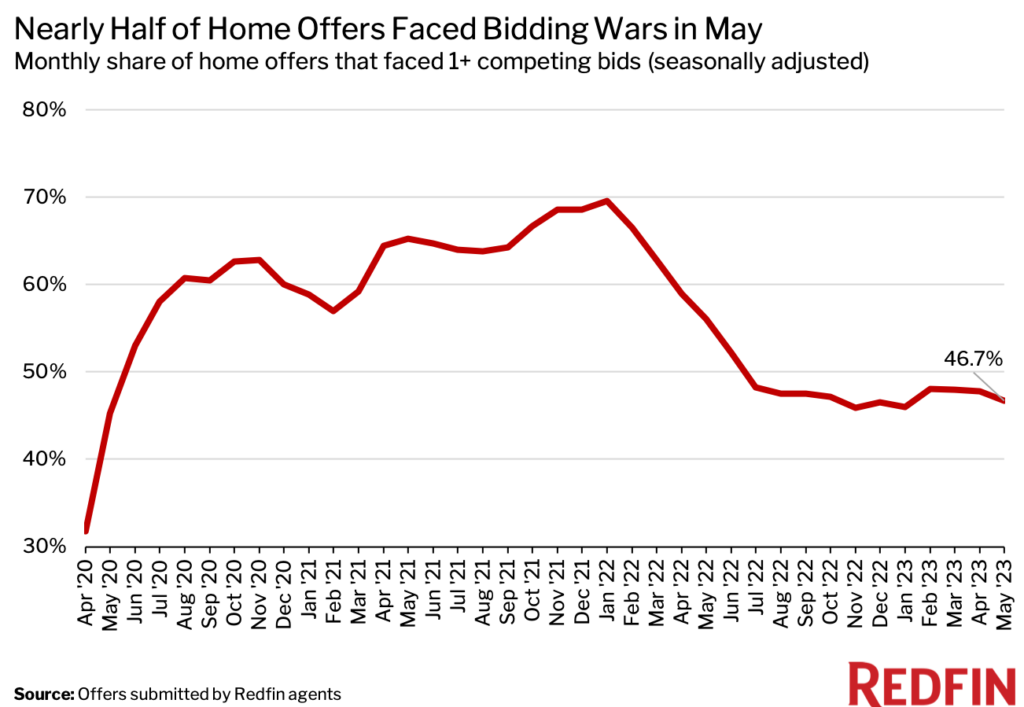

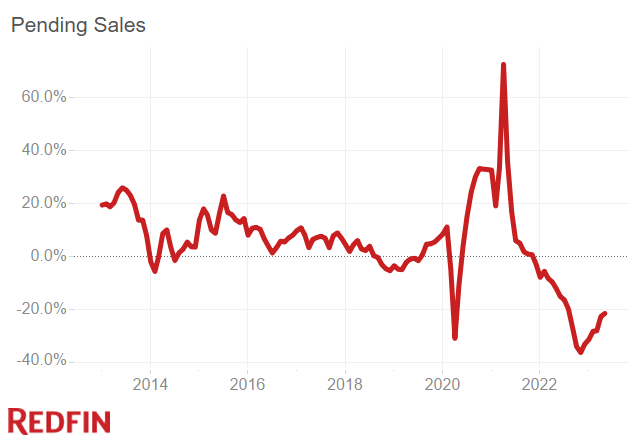

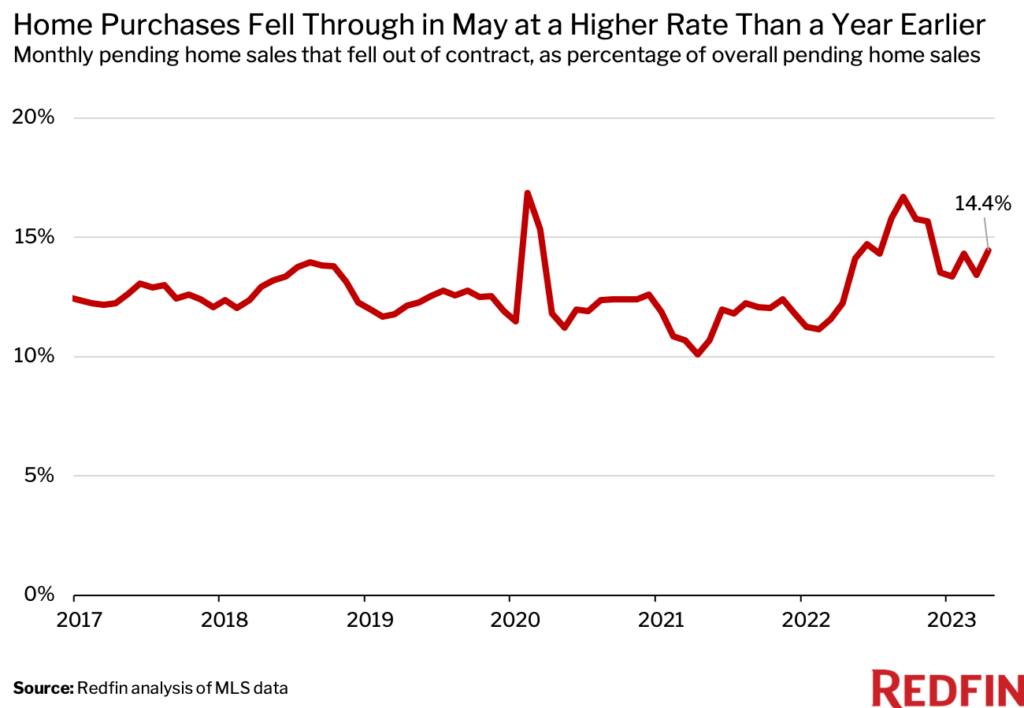

However, rising mortgage rates have moved some buyers out of the market, and while the percentage looking to move farther from home increased, the total number of buyers looking to move has decreased – down 7% from a year ago and the biggest decline on record, according to a report from Redfin.

Still, out-of-town moves have held up better than in-town moves. The number of homebuyers looking to move within their current hometown is down a record 18%. In other words, the overall homebuying pie has shrunk, but buyers moving to a new metro make up the biggest piece of that pie on record.

Top 10 U.S. move-to-metros in May 2023

- Phoenix: Net inflow at 8,100. Top move-from destination is Seattle

- Las Vegas: Net inflow at 6,900. Top move-from destination is Los Angeles

- Miami: Net inflow at 6,900. Top move-from destination is New York City

- Tampa: Net inflow at 9,000. Top move-from destination is New York City

- Orlando: Net inflow at 1,400. Top move-from destination is New York City

- North Port-Sarasota: Net inflow at 4,900. Top move-from destination is Chicago

- Cape Coral: Net inflow at 4,600. Top move-from destination is Chicago

- Dallas: Net inflow at 4.500. Top move-from destination is Los Angeles

- Sacramento, Calif.: Net inflow at 4,300. Top move-from destination is Chicago

- Houston: Net inflow at 63,700. Top move-from destination is New York City

Net inflow is a measure of how many more Redfin.com users looked to move into an area rather than leave.

“Climate risks haven’t yet stopped many homebuyers from moving into areas that don’t have enough water, like Phoenix, and places that could eventually be underwater, like coastal Florida,” says Redfin Chief Economist Daryl Fairweather. “That’s because even though Sun Belt home prices soared during the pandemic, those metros remain a bargain for people relocating from expensive coastal cities.”

© 2023 Florida Realtors®