Housing remained resilient – Florida more than many states – but signs suggest a slowdown in price increases. Still, investors moving away from stocks may be a wild card.

NEW YORK – The Florida and national housing market remain very strong by every metric, but the overall health of the United States’ economy, inflation worries, interest rate hikes, and the downward spiral of many investment markets are starting to create some buts in the housing forecast long-term.

The overall economy will affect housing especially with regard to increased interest rates, but through the first quarter of 2022, housing has been very resilient.

In March, per the United States Census Bureau, United States housing starts hit an annual seasonal rate of 1,873,000 which was 0.4% higher than February, and 6.7% above the previous year.

Within those numbers, single-family homes cooled by almost 5%, but multi-family housing bolstered the sector to an increase. Because of the COVID-19 pandemic, multi-family housing projects have been delayed, but with the current rental demand, most expect multi-family housing to grow.

The dirty secret about these numbers is that starts would have been higher if not for supply chain woes. Housing starts and production are being suppressed because of serious supply chain issues throughout the country.

The Monthly New Residential Sales report from the Census Bureau tells a different story, which may suggest interest rates and the economy may be slowing new home sales. Sales were 763,000 units which is 12.6% below the previous year, but the median price rose to $436,700 with a 6.4-month supply at current sales volume.

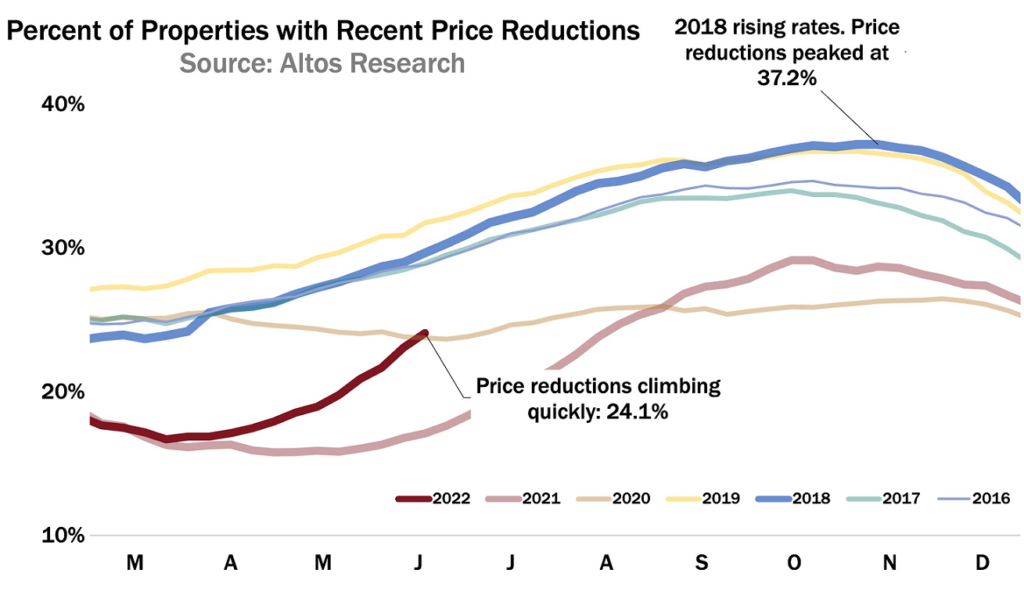

The buyers remain in the market, but many are being priced out by higher interest rates and soaring prices for homes. This may be an inflection point in which home sellers will have to start reducing the prices to attract buyers since the low interest rate environment is going away.

Some point to the fact that a late winter weather surge could have hampered sales in March and getting buyers back in the market may soon become a priority for sellers. In short, housing prices coupled with higher interest rates are too much for many buyers.

Florida’s housing numbers are somewhat robust as compared to the national housing markets. Florida Realtors® reports that first quarter sales of housing were down 2.6% compared to the previous year, but housing inventories across the state were down to 1 month or a 10.2% drop as compared to the previous year.

This indicates sales were subdued because there were simply not enough houses in the market for sale. Additionally, the median sales price jumped 21.3% from the previous year to $385,000 while new listings for the quarter were flat from the year before.

Here is another key fact; homes on the market were down to 53 days as compared to 64 days a year ago. The Florida housing market remains red hot, and builders simply cannot build enough units timely with all the supply chain disruptions.

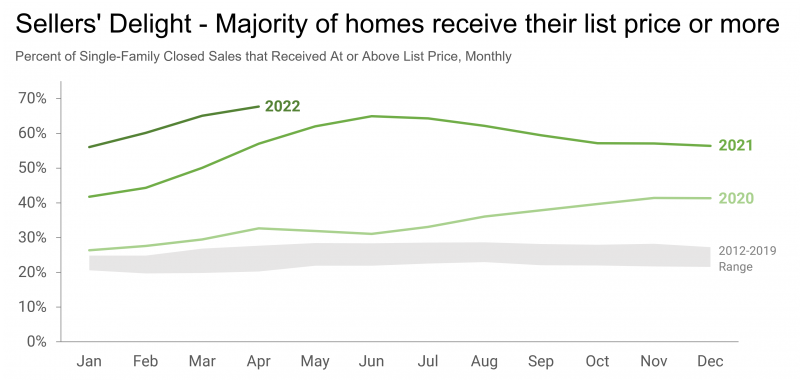

Two other big facts about Florida’s housing market that cannot be ignored are the percentage of cash sales for new homes and the rate of foreclosures. For the first quarter, cash buyers made up 33.5% of all the homes sold while foreclosures across the state were down 34.8% to a measly 362 units, which is nothing for a state of 23 million people. It seems money is moving out of Wall Street and other investments to real estate, and that most homes are in good shape financially.

With all these first quarter numbers and economic data, where does the housing market go the rest of 2022? First, the Florida market will probably be one of the most robust markets in the country, but all markets, including Florida’s, will start seeing some capitulations in housing prices.

Low interest rates have shielded sellers for some time, and with a forecasted rise in interest rates in June and July of half points on top of the May half point increase, something has got to give on pricing.

What about Wall Street investors?

Here is the big but: Do large amounts of money flow out of riskier investments on Wall Street and cryptocurrency find a safe haven in real estate? That is a possibility as builders and investors build rental housing for a population dealing with a lack of housing.

Unlike some of the funny money investments on Wall Street, housing does provide one huge advantage as a tangible investment that delivers real value like a place to live and a nice tax advantage, plus there is a genuine need for more housing in America.

It appears housing will cool some in other parts of the country, which should help ease supply chain disruptions. Additionally, pricing overall will moderate, probably knocking out the over-exuberance; but in Florida, unless the economic conditions deteriorate significantly, expect housing to remain strong.

If you are a home seller, the environment suggests you sell sooner rather than later.

Copyright © 2022, Daily Commercial, all rights reserved. Don Magruder is the CEO of Ro-Mac Lumber & Supply Inc., and he is also the host of the “Around the House” Show which can be seen at AroundtheHouse.TV.