By Jennifer Warner

Florida Realtors economist: The RE market changed rapidly this year, and the frenzy to buy-sell faded as more owners and renters decided to just stay where they are.

ORLANDO, Fla – What really unleashed demand for housing over the last few years more than Covid-related remote-work policies? Record low interest rates that expanded all buyers’ purchasing power.

First-time buyers in particular didn’t have the benefit of existing equity to make a down payment, and they were able to get into the game as affordability and low-borrowing costs combined to make deals a sudden reality. It created a somewhat “magical time” in residential real estate.

The result: Some 85% of U.S. homeowners with mortgages currently have an interest rate less than 5%, according to Redfin. That’s a lot of people who are not incentivized to transact if there isn’t some other pressing need to move.

By and large, potential sellers missed the peak pricing achieved by homeowners who sold earlier. And buyers have seen their purchasing power diminish over the last 12 months as interest rates steadily increased at one of the fastest paces the market has seen in a long time. While the level today isn’t altogether painful relative to some earlier times, the pace of rate hikes has been exceedingly problematic.

Buyers are wary about taking on a high-priced home at a higher interest rate. Sellers are holding onto their homes secured with low interest rates, not wanting to enter a marketplace that has become exceedingly more expensive. A mortgage taken out at the peak of the market in July 2022 was $1,877 – 44% more per month than 2020’s lowest point.

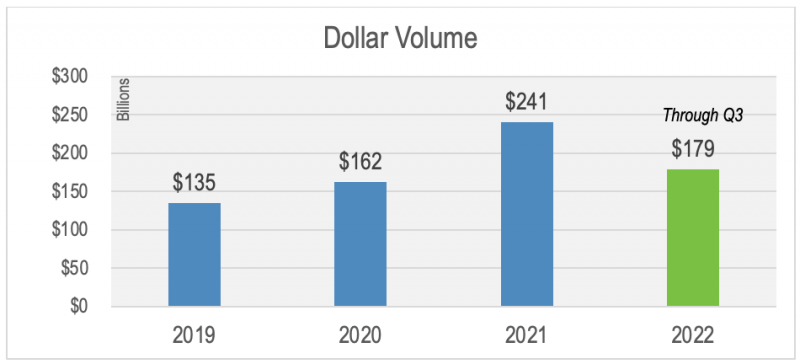

Dollar volume for transactions is reflective of this stabilization among buyers and sellers. Through the third quarter of 2022, the total dollar volume for sales in Florida is around $179 billion. This is still a very strong year overall that’s surpassing what we thought was a dynamite year in 2020 – but won’t exceed 2021’s banner year.

What’s a Realtor to do?

This means that the market will likely start to have some sanity in it again. Gone are deals that hardly make sense, waived contingencies and inspections, and offers tens of thousands over ask. As you start to make your plans for 2023, think back to the strategies that made you successful in 2019.

Also remember that residential real estate is different in many ways to most commodity markets in that people will still transact as life circumstances changes. Families will still expand and contract; people will still move for their jobs; people will still invest in the American Dream of homeownership. Knowing the obstacles people face will help you bring creativity to the table when working in this new economic climate. Know what you’re up against and make a plan to survive and, ultimately, thrive.

How did we get here?

The Covid pandemic kicked off one the largest population shifts in recent history. We wrote about it back in 2021, highlighting many of the reasons people decided to change their living situations. For them, this could mean finally making that move to the suburbs or even making that move to a new state. Not only did freedom from a daily commute upend where people lived, but so did buyer’s preferences. Condensed, urban living was readily traded in for locales with more space.

This magical time, with interest rates at or below 3%, lasted from about August 2020 until January 2022. Prices didn’t really start picking up steam in Florida until around the fourth quarter of 2020, but the low rates helped keep the monthly payment affordable.

The monthly payment for a median-priced home ($315,000) in August 2020 when interest rates were at 3% was $1,059. By January 2022, prices had increased by about 14% to around $365,000, and with the interest rate still holding around 3%, it made that payment increase in kind by 15% to $1,243.

This magical time got a lot of people into homes for the first time, allowed them to sell their starter home and move into a larger home, or refinance their existing mortgage to a much lower rate. Total dollar volume in Florida reflects this boom time. In 2019, total sales volume for all property types was relatively in line with historical norms at around $135 billion for all property types. In 2020, dollar volume climbed by 20% year over year. Still, 2021 was even stronger, with dollar volume smashing historic norms by growing 48% year over year, or about 78% over 2019’s already strong number.

Jennifer Warner is an economist and Florida Realtors Director of Economic Development

© 2022 Florida Realtors®