Florida was 2nd in states with most foreclosure starts, Miami was one of the major metros with most foreclosure starts and Jacksonville was for highest foreclosure rates.

IRVINE, Calif. – ATTOM has released its July 2024 U.S. Foreclosure Market Report, which shows there were a total of 31,929 U.S. properties with foreclosure filings default notices, scheduled auctions or bank repossessions – up 15% from a month ago and up slightly by 0.2% from a year ago.

“July’s foreclosure activity reflects a slight shift in the housing market,” said Rob Barber, CEO at ATTOM. “With an 18% increase in foreclosure starts and a 14% rise in completed foreclosures from last month, these shifts may highlight growing pressures in certain areas.

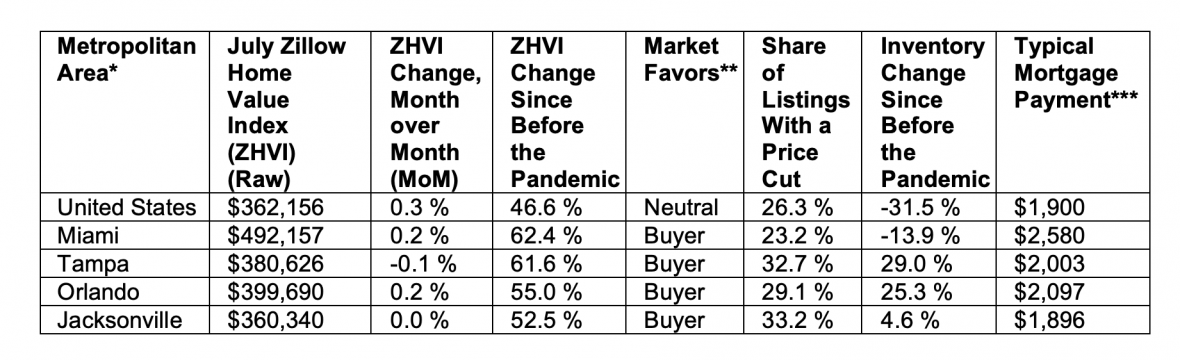

“However soaring home prices seem to continue and have spiked the value of homes across the nation, which boosts equity for homeowners at virtually every stage of paying off mortgages. Monitoring these next few months will help us better understand the implications for the real estate sector.”

Delaware, Nevada, and Utah post highest foreclosure rates

Nationwide, one in every 4,414 housing units had a foreclosure filing in July 2024. States with the highest foreclosure rates were Delaware (one in every 2,214 housing units with a foreclosure filing); Nevada (one in every 2,245 housing units); Utah (one in every 2,289 housing units); New Jersey (one in every 2,607 housing units); and Illinois (one in every 2,660 housing units).

Among the 224 metropolitan statistical areas with a population of at least 200,000, those with the highest foreclosure rates in July 2024 were Provo-Orem, UT (one in every 940 housing units with a foreclosure filing); Macon, GA (one in every 1,167 housing units); Columbia, SC (one in every 1,587 housing units); Spartanburg, SC (one in every 1,895 housing units); and Atlantic City-Hammonton, NJ (one in every 1,910 housing units).

Those metropolitan areas with a population greater than 1 million with the worst foreclosure rates in July 20244 were: Las Vegas, NV (one in every 2,089 housing units); Philadelphia, PA (one in every 2,197 housing units); Jacksonville, FL (one in every 2,274 housing units); Chicago, IL (one in every 2,279 housing units); and Riverside, CA (one in every 2,556 housing units).

Greatest numbers of foreclosure starts in California, Florida, and Texas

Lenders started the foreclosure process on 21,870 U.S. properties in July 2024, up 18% from last month and up 4% from a year ago.

States that had the greatest number of foreclosure starts in July 2024 included: California (2,342 foreclosure starts); Florida (2,339 foreclosure starts); Texas (2,222 foreclosure starts); Illinois (1,221 foreclosure starts); and New York (1,145 foreclosure starts).

Those major metropolitan areas with a population greater than 1 million that had the greatest number of foreclosure starts in July 2024 included: New York, NY (1,286 foreclosure starts); Chicago, IL (1,555 foreclosure starts); Philadelphia, PA (782 foreclosure starts); Miami, FL (758 foreclosure starts); and Los Angeles, CA (689 foreclosure starts).

Foreclosure completion numbers increase from last month

Lenders repossessed 3,282 U.S. properties through completed foreclosures (REOs) in July 2024, up 14% from last month and down 2% from last year.

States that had the greatest number of REOs in July 2024, included: New York (377 REOs); California (370 REOs); Illinois (221 REOs); Pennsylvania (219 REOs); and Michigan (212 REOs).

Those major metropolitan statistical areas (MSAs) with a population greater than 1 million that saw the greatest number of REOs in July 2024 included: New York, NY (271 REOs); Chicago, IL (136 REOs); San Francisco, CA (104 REOs); Detroit, MI (100 REOs); and Los Angeles (97 REOs).

Copyright © 2024 BridgeTower Media, The Mecklenburg Times. All rights reserved.