May 26, 2023 by Dana Anderson - Redfin

- Fewer homebuyers are looking to move to a different part of the country–but the dropoff isn’t as big as it is for those remaining close to home.

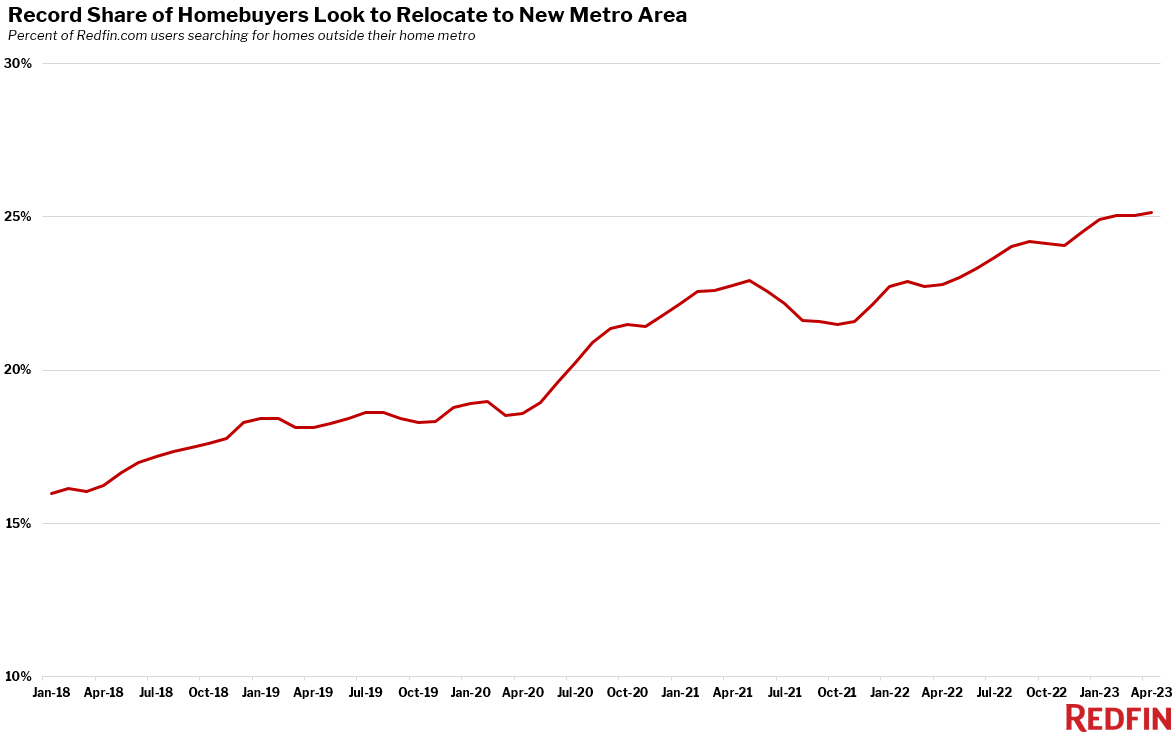

- To put the trend another way, people moving to a new metro make up a bigger piece of the homebuying pie than ever before, with a record 25.2% of Redfin.com users nationwide looking to relocate.

- 5 of the 10 most popular migration destinations are in Florida, and nearly all are in the Sun Belt. Relatively affordable, sunny metros are the most popular for relocating homebuyers.

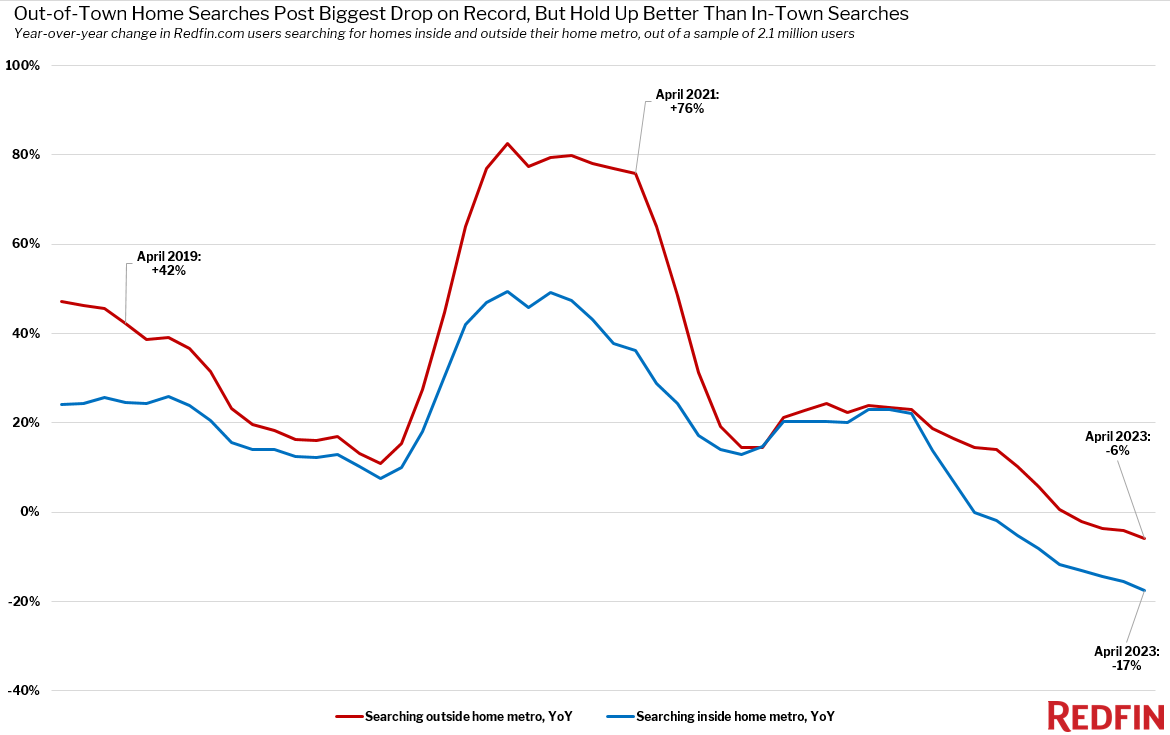

The number of Redfin.com users looking to move to a different part of the country is down 6% from a year earlier, the biggest drop on record, as the overall U.S. housing market remains cool in the face of high mortgage rates and economic uncertainty. That’s a big swing from a year ago at the tail end of the pandemic homebuying boom, when it rose 23%.

But out-of-town moves are holding up well compared with in-town moves: The number of Redfin.com users looking to move within their current metro area is down 17%, roughly three times the drop for relocators. That’s also the biggest drop in Redfin’s records, which go back through 2018.

The data in this report is based on the search activity of about two million Redfin.com users who viewed for-sale homes online across more than 100 metro areas from February 2023 to April 2023. Scroll down for more methodology details.

To put the trend another way, the overall homebuying pie is smaller than it was a year ago–but Americans moving to a new metro make up a bigger piece of that pie than ever before. A record one-quarter (25.2%) of Redfin.com users nationwide are looking to relocate. That’s up from 22.8% a year earlier and roughly 19% just before the pandemic started.

Out-of-town moves among homebuyers have declined from a year ago because fewer people are moving. Overall home sales dropped 22% from a year earlier in April as elevated mortgage rates and a shortage of inventory deterred buyers.

But out-of-town moves have dropped substantially less than within-metro moves for a few reasons:

- Many buyers leaving their hometown are moving to more affordable areas (Los Angeles to Las Vegas or New York to Tampa, FL, for instance). High mortgage rates aren’t as big of a deterrent for someone selling an expensive home and buying a cheaper one. Remote work makes moving feasible for a lot of people.

- For first-time buyers, high mortgage rates may encourage relocation to a different metro area. The ongoing affordability crunch, with high rates and still-high home prices, makes cheaper locales attractive.

- People who are moving to an entirely different area often do so for an immutable reason like a new job or to take care of a family member. That’s compared with would-be buyers looking in their current metro, who may be more apt to delay homebuying plans because they’re simply looking for more space or a different layout.

Florida is the most popular state for relocating homebuyers

Phoenix and Miami are the most popular destinations for Redfin.com users looking for homes in a different part of the country, followed by Las Vegas, Tampa, FL and Orlando, FL. Five of the top 10 destinations are in Florida, and nearly all are in the Sun Belt. Popularity is determined by net inflow, a measure of how many more Redfin.com users looked to move into an area than leave.

Relatively affordable, warm-weather metro areas with low taxes are typically popular for homebuyers relocating to a different part of the country. They’re especially sought-after destinations for people leaving expensive coastal job centers: For instance, Seattle (median sale price: $770,000) is the most common origin for homebuyers moving to Phoenix ($439,000), and Los Angeles ($830,000) is the most common origin for those moving to Las Vegas ($400,000).

Florida soared in popularity as the pandemic-driven remote-work trend took hold, with many Americans moving there for the relatively affordable housing and sunshine. That’s in spite of worsening natural disasters. The Sunshine State is still a magnet for relocating homebuyers, many of whom come from cold northern metros. New York is the most common origin for homebuyers moving to Miami, Tampa and Orlando, and Chicago is the most common for those moving to North-Port Sarasota and Cape Coral.

But as is true nationally, the number of Redfin.com users moving to Florida metros has declined over the last year as fewer people buy homes overall. The net inflow of homebuyers into Miami, for instance, was nearly 13,000 a year ago, and now it’s 7,500. The net inflow into Tampa was about 9,000 a year ago, versus about 6,000 now.

“About half of the people buying homes here are from out of town, and some are able to pay cash,” said Orlando Redfin Premier agent Nicole Dege. “That’s making it difficult for some locals to get their offers accepted, especially because many people have limited budgets due to high mortgage rates and there are so few homes coming on the market. Even though fewer people are coming in from out of town, there are also fewer homes for sale.”

| Top 10 Metros Homebuyers Are Moving Into, by Net Inflow Net inflow = Number of Redfin.com home searchers looking to move into a metro area, minus the number of searchers looking to leave | |||||

| Rank | Metro* | Net Inflow, April 2023 | Net Inflow, April 2022 | Top Origin | Top Out-of-State Origin

|

| 1 (tie) | Phoenix, AZ | 7,500 | 9,100 | Seattle, WA | Seattle, WA |

| 1 (tie) | Miami, FL | 7,500 | 13,000 | New York, NY | New York, NY |

| 3 | Las Vegas, NV | 6,400 | 7,100 | Los Angeles, CA | Los Angeles, CA |

| 4 | Tampa, FL | 5,800 | 9,000 | New York, NY | New York, NY |

| 5 | Orlando, FL | 5,300 | 1,900 | New York, NY | New York, NY |

| 6 | North Port-Sarasota, FL | 5,000 | 6,300 | Chicago, IL | Chicago, IL |

| 7 | Cape Coral, FL | 4,700 | 6,800 | Chicago, IL | Chicago, IL |

| 8 | Dallas, TX | 4,700 | 6,400 | Los Angeles, CA | Los Angeles, CA |

| 9 | Sacramento, CA | 4,600 | 8,800 | San Francisco, CA | Chicago, IL |

| 10 | Houston, TX | 4,000 | 5,300 | New York, NY | New York, NY |

| *Combined statistical areas with at least 500 users searching to and from the region in February 2023-April 2023 | |||||

Homebuyers are leaving coastal California and New York

More homebuyers are looking to move away from San Francisco, New York, Los Angeles, Washington, D.C. and Boston than any other metro in the country. The list of places homebuyers are leaving is determined by net outflow, a measure of how many more Redfin.com users are looking to leave a metro than move in.

Expensive coastal places, especially tech hubs like the Bay Area and Seattle, typically top the list of places homebuyers are leaving. Homes in those areas are pricey, and people–especially remote workers–often leave in favor of places where housing and overall cost of living is cheaper.

| Top 10 Metros Homebuyers Are Leaving, by Net Outflow Net outflow = Number of Redfin.com home searchers looking to leave a metro area, minus the number of searchers looking to move in | ||||||

| Rank | Metro* | Net Outflow, April 2023 | Net Outflow, April 2022 | Portion of Local Users Searching Elsewhere | Top Destination | Top Out-of-State Destination

|

| 1 | San Francisco, CA | 29,800 | 40,500 | 24% | Sacramento, CA | Seattle, WA |

| 2 | New York, NY | 24,200 | 25,100 | 28% | Miami, FL | Miami, FL |

| 3 | Los Angeles, CA | 20,400 | 29,500 | 18% | Las Vegas, NV | Las Vegas, NV |

| 4 | Washington, D.C. | 17,500 | 19,000 | 19% | Miami, FL | Miami, FL |

| 5 | Boston, MA | 5,300 | 10,100 | 20% | Portland, ME | Portland, ME |

| 6 | Seattle, WA | 4,300 | 19,600 | 20% | Phoenix, AZ | Phoenix, AZ |

| 7 | Denver, CO | 3,900 | 5,200 | 35% | Chicago, IL | Chicago, IL |

| 8 | Hartford, CT | 3,400 | 900 | 76% | Boston, MA | Boston, MA |

| 9 | Minneapolis, MN | 3,000 | 2,100 | 34% | Chicago, IL | Chicago, IL |

| 10 | Chicago, IL | 2,900 | 4,900 | 16% | Cape Coral, FL | Cape Coral, FL |

| *Combined statistical areas with at least 500 users searching to and from the region in February 2023-April 2023 | ||||||

Below is a map of the most common origins for Redfin.com users who are moving to the Miami metro. To view similar maps for the metros in this report and other metros, please visit the area’s Redfin housing market page and scroll down to the “migration” section.

Methodology

Our migration analysis is based on about two million Redfin.com users who viewed for-sale homes online across more than 100 metro areas from February 2023 to April 2023. To measure the share of homebuyers looking to relocate from one metro to another, we calculate the portion of overall home searchers that are migrants.

A Redfin.com user counts as a migrant if they viewed at least 10 for-sale homes in the relevant three-month period and at least one of those homes was outside their home metro area. For instance, if a Redfin.com user based in Seattle views 10 homes in a three-month period and all of them are in Phoenix, that user counts as a full migrant to Phoenix. If a user based in Seattle views 10 homes in a three-month period and five are in Phoenix but five are in San Diego, that user counts as half of a migrant to Phoenix and half of a migrant to San Diego. If a user based in Seattle views 10 homes in a three-month period, nine in Seattle and one in Phoenix, that user counts as one-tenth of a migrant to Phoenix.

The analysis includes combined statistical areas with at least 500 Redfin.com users based in that region and at least 500 users searching for homes in that region. For instance, a user based in Seattle searching for a home in Phoenix counts toward the first condition, a user based in Phoenix searching for a home in Seattle counts toward the second condition, and a user based in Seattle searching for a home in Seattle counts toward both. Redfin’s migration data goes back to 2017.

As a data journalist at Redfin, Dana Anderson writes about the numbers behind real estate trends. Redfin is a full-service real estate brokerage that uses modern technology to make clients smarter and faster. For more information about working with a Redfin real estate agent to buy or sell a home, visit our Why Redfin page.